CHOOSE THE RIGHT MUTUAL FUNDS BY ANALYZING THE RISK

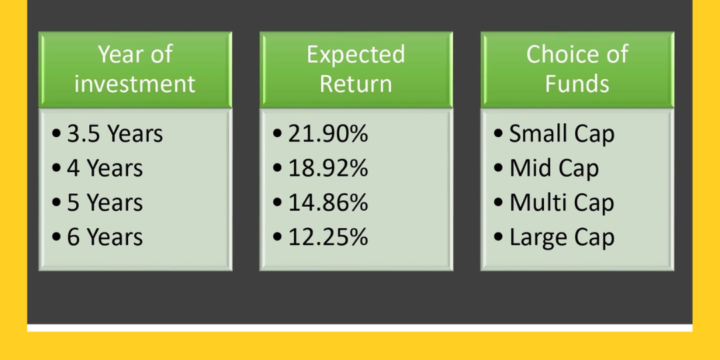

A mutual fund is the best option on the date to invest for long-term goals. It has several advantages: lower cost of investing, very liquid, higher safety compared to other products, and tax-efficient. A mutual fund is also diversifying investor’s money into the different Asset classes. It is less risky than equity, as fund units are professionally managed. It is highly operational transparent, and user friendly. The selection of investing in a mutual fund is generally guided by two criteria: The investor would prefer to invest in the lowest risk fund with the same expected return in a specific time frame in two funds.The investor would prefer the higher expected return in portfolios of two funds with the same risk. RISK ANALYSIS OF MUTUAL FUNDS An investor should make an…