A mutual fund is the best option on the date to invest for long-term goals. It has several advantages: lower cost of investing, very liquid, higher safety compared to other products, and tax-efficient. A mutual fund is also diversifying investor’s money into the different Asset classes. It is less risky than equity, as fund units are professionally managed. It is highly operational transparent, and user friendly.

The selection of investing in a mutual fund is generally guided by two criteria:

- The investor would prefer to invest in the lowest risk fund with the same expected return in a specific time frame in two funds.

- The investor would prefer the higher expected return in portfolios of two funds with the same risk.

RISK ANALYSIS OF MUTUAL FUNDS

An investor should make an investment strategy based on risk-tolerance capacity. Risk tolerance capacities differ from person to person and also their age. Investors generally focus only on the returns of the fund, irrespective of risk. However, it is vital to consider the risk aspect of the investment since risk and returns are two sides of the same coin. You can assess with risk & returns of one mutual fund within the same category with other mutual funds with a specific period say 3 / 5 /10 years.

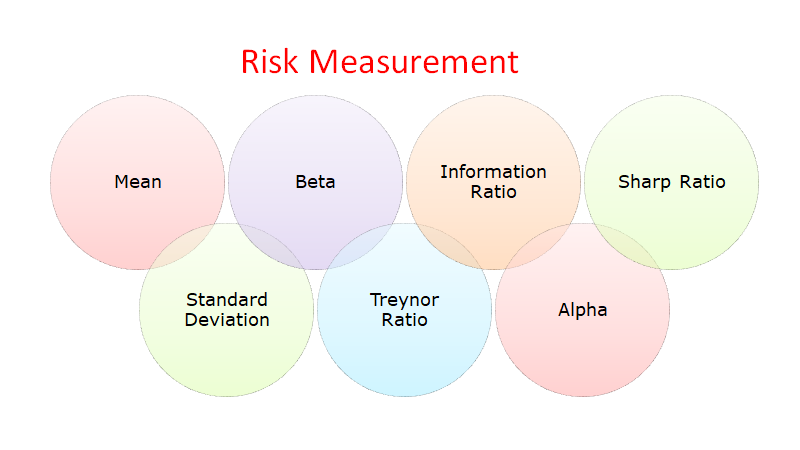

There are certain conditions based on which the performance of mutual funds can be assessed. Popular ratios to measure risk in mutual funds are Standard deviation, Beta & Alpha. The above ratios can be used to evaluate the performance, risk, and returns of a mutual fund.

Standard Deviation:

Standard deviation is a measure of the total risk of a fund. The standard deviation of a fund measures the degree to which the fund fluctuates to its average return for a fund over a period of time. A high standard deviation denotes high volatility. If a fund has a standard deviation of 14.38%, it has a tendency to deviate by 14.38% from its average category return.

Beta:

Beta is a measure of the volatility or systematic risk of a portfolio compared to the market. It is a statistical measure of non-diversifiable or systematic risk that shows how sensitive a fund is to moves based on market forces. The beta for the overall market is equal to 1. Equity funds can have beta values, which can be above, less than or equal to one. They can be positive or negative.

Basically, beta expresses the fundamental trade-off between minimizing risk and maximizing returns. A fund with a beta of 1 will historically move in the same direction as the market. A beta above 1 is more volatile than the overall market, while a beta below 1 is less volatile. If a fund beta is 1.05, it is marginally more volatile than the overall market. If the Sensex is expected to provide a 10 percent rate of return in the next year, for example, a fund having a beta of 1.05 would be expected to give an increase of return of approximately 10.50% (1.05*10) over the same period.

Alpha:

Alpha takes the volatility (price risk) of a fund portfolio and compares its risk-adjusted performance to a benchmark index. Hence, the “alpha” is the excess returns of a fund compared to the benchmark index returns.

A positive alpha means the fund has outperformed its benchmark index. On the other hand, a negative alpha indicates the fund has underperformed compared to the benchmark index. If a fund alpha is 7.50, the fund has outperformed by 7.50% more than its benchmark index.

All these performance measurements help you determine the risk and reward factors of your investments.

FOCUS ON THE LONG-TERM INVESTMENT

Like equity, mutual funds are also affected by economic, political, and sociological factors. However, mutual funds generate consistency return over the long-run. You can achieve your goals over medium to long-run by investing in the right mutual funds.

You can expect a return percentage per annum over the long-run by investing your choice of funds: Large, Multi, Mid & Small-cap funds. Make a suitable and meaningful plan and invest in different categories of funds.

Winner of Literary Titan Gold Award 2020

“It is a wise decision to fill your basket with vegetables, fruits, milk, and egg if you want to be healthy and fit. Diversification keeps you financially fit and protects you from the volatility of the market, as it reduces the risk exposure in your portfolio.”

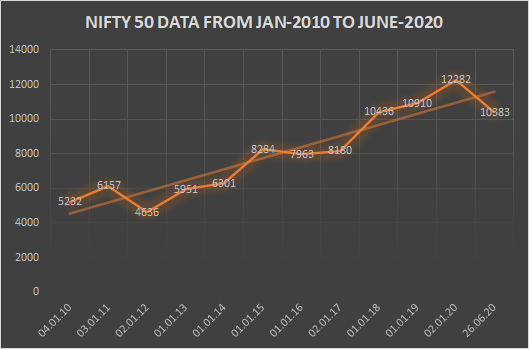

Nifty 50 is a diversified 50 stock index of Indian companies across 14 sectors, where the weightage finance sector is more than 35 percent. The Nifty was down more than 35 percent to 7610 on March 23, 2020, from its all-time high of 12311 January 10, 2020.

The pandemic and the nationwide lockdown have pushed the Indian economy into a territory of uncertain magnitude. It was severely impacted in supply chains, logistics, and the suspension of operation for almost all companies (small, medium, and big).

Nobody makes predictions of share prices based on the fundamental of the company and also price-earnings multiple of the market. The capital market may test another 10 to 15 percent further down shortly due to the uncertainty of the vaccine of novel coronavirus and other global turmoil as well as underlying economic factors.

The Nifty 50 yielded returns at a CAGR of 8.06 percent over the last 10 years as of January 20. Based on the past data and a CAGR OF 8.06%, an Investor can predict that the NIFTY 50 Index will touch the level of 15500 on January 23. That means the Nifty will grow near about 49% from the current level (10383). Hence, Investors should invest in an index fund by utilizing the best opportunity of the current market and earn a decent return in the future.

Historically, there has never been an instance of negative performance for 10 years and above. As the tenure of investment increases, the probability of negative performance decreases.

Equities deliver strong returns with lower downside risk in the long term, compare to debt instruments such as bonds, debentures, and govt. Securities. Hence, equity and equity-related investments should always be in the long run, ideally more than five years. One can assume returns of 12–15 percent over a longer horizon.

You can assess the concentration percentage while choosing a mutual fund. Top holding percentages of shares show how the fund will generate returns over the short-run and the long-run period. It is prudent for investors to invest in large-cap, multi-cap & diversified equity mutual fund schemes, rather than aggressively investing in mid-cap and small-cap funds.

Investment of shares during your lifetimes may give you 5 times positive return and 50 times negative return. It is not a process of a win-win system. Generally, the small investor may not make money by investing in equity and equity-related products due to a lack of knowledge and expertise about the capital market. If you have known the actual market trend, you can win in this volatile market, otherwise not. As a speculative effect, demographic factors, micro factors, macro factors, fluctuation of currency & political stability play an important role in the capital market.

Therefore, it is advisable to invest in equity and mutual funds by consulting with an expert, which lower your investment risk by comparing direct investment in equity and mutual funds.

If you need any support for portfolios allocation, get in touch with me, and I will help you as best I can.