As per the existing provision of the Income Tax Act, on redemption of debt mutual funds held by you for three years or more, they are considered long-term capital gains, can avail of the indexation benefit, and are taxed at a flat rate of 20% after indexation or 10% without indexation. On the contrary, if your holding period in a debt mutual fund is less than three years, any gain that arises on redemption is taxable at the investor’s tax slab rate.

But, in the Annual budget 2023, any capital gain on redemption of debt funds purchased on or after April 1, 2022, will be taxed as per the income tax slab rate applicable to your income. Therefore, it can help you defer taxes. Like FDRs, now you must pay income tax on the redemption of debt mutual funds as per your tax slab rate.

However, it won’t affect investments made in debt funds, gold mutual funds, overseas funds, and funds of funds until March 31, 2023. They will still be eligible for preferential long-term capital gains tax treatment.

We often do not think about tax consequences when making investment decisions. We feel happy if we get 7 to 8% interest from a Bank FDR / Bonds. However, the effective post-tax return for those who are in the highest tax bracket (30%) is 5 – 6% only.

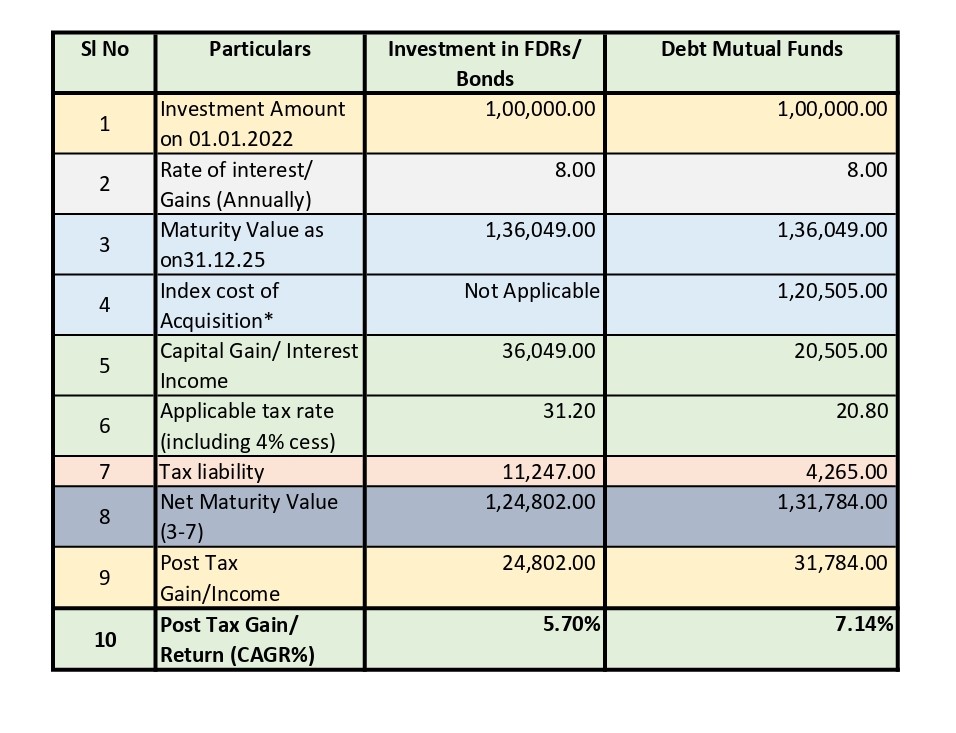

Let us examine how indexation benefits change your income:

*Index cost of Acquisition calculated assuming value of 382 of CII for FY 2025–26 and 317 of CII for FY 2021-22.

With effect from 01.04.23, indexation benefit investment in debt mutuals funds will not be available. The investor will pay 31.20% tax if they fall under a bracket of 30% for both products.

This is a hypothetical example explained by the computation of the taxation of both products. However, the real gain or income may vary based on your investment and time horizon.

However, in comparison with FDR’s income and Debt Mutual fund gains, there are still several reasons that show Debt Mutual Funds are a tax-efficient product.

- Debt mutual funds generate higher income than FDRs.

- It can help you defer taxes, as you can pay tax every year on an accrual basis on your FDs.

- There is no penalty/exit load on redemption of Debt Mutual funds after a certain period, and for regular FD, you may have to pay a penalty for early withdrawal. Therefore, debt mutual funds have provided greater liquidity and are more cost-effective than Bank FDRs.

- Gains on debt mutual funds are classified as ‘Capital Gains’, whereas the income of FDRs comes under the Head’s Income from other sources. Hence, in the event of losses on debt mutual funds, they can be carried forward and offset against capital gains.

Mutual fund investments are subject to market risks. Consult your advisor before investing in any products if you cannot understand them properly.